Check the documents and conditions necessary for proceeding with a full installment vehicle mortgage without warehousing

In daily life, you may suddenly need a lot of money.You don’t have to worry if you have the necessary funds in advance or if you have a pocketbook, otherwise you will be stressed all day.When the economic situation is not good like now, it is difficult to ask even family members or acquaintances, and even if you go to the bank, it is difficult to raise funds due to various regulations.

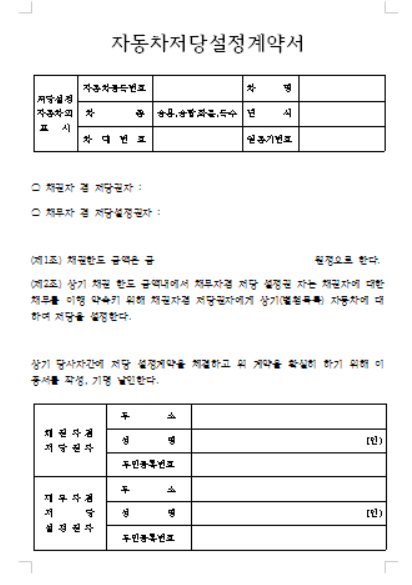

So today, we’re going to look at how you can get a non-entry loan using your car as collateral.You may feel unfamiliar with non-entry vehicle mortgage loans, but it is an auto loan service supported by a normal financial institution, so if you need information, please read it one by one.Prior to the conversation, we would like to inform you that the entire process is non-face-to-face and that since it is a vehicle mortgage product without entering the institutional financial company, you can receive refinancing or additional forms even if you are already using installments.It is possible regardless of the type of vehicle such as domestic or imported cars, and can be applied to wagons, trucks, and freight cars, but according to the current standard, less than 200,000km of mileage must be confirmed based on vehicles shipped within 10 years.The reason for checking the model year and driving distance is that too many old vehicles or driving can cause engine or other parts, which are a kind of consumable goods, to fail, and there is a high possibility of corrosion or damage.If only the above conditions apply, any Korean over the age of 20 can apply, and if he or she owns a private car only one day later, he or she can be recognized as an asset.It is most convenient to proceed under a single name, but even if it is jointly owned, limited approval can be obtained with the consent of the other party.In addition, the biggest advantage of non-entry vehicle mortgage loans is that they are possible even if they do not have income evidence.Even college students, housewives, unemployed people, and freelancers do not receive disadvantages because they do not need employment information or income documents.As those who have recently made loan transactions know, the biggest issue is dsr and ltv regulations, so I think it will be a great advantage to be able to proceed without a fixed source of income.I think most people who own used cars used the installment program when they first bought it, but sometimes the contract is terminated, but you can proceed with a full installment mortgage even if you have a balance left.It will be applied differently depending on the set rate, but you can borrow or leave the existing vehicle loan balance as it is.In this process, it may be up to 100 million won if you prove your income, and if it is difficult to prove, it can be applied at around 70 million won.If you look at it a little bit, it’s a very convenient and has many advantages, but you can’t get approval for a non-entry vehicle mortgage just because you own a car.Among some non-compliance, vehicles, rental cars, and leased cars under the company’s name are limited because they are not recognized as personal property, and if seized or personalized or fined when reading the register, they must be terminated.In addition, the borrower’s credit rating should be basically based on it, so there should be no more than 500 points, overdue or unpaid.Today, we talked about how to raise funds from installment vehicles in operation, their advantages, and what is applied advantageously.Due to credit loan regulations, many people are wondering about the eligibility conditions for non-entry vehicle mortgage loans, but there are also notable cases where they are sometimes damaged.It is true that the development of the Internet has made it easier to collect information, but indiscriminate inquiries that provide personal information should be refrained from, and unregistered companies or private loan businesses should be avoided if possible.Also, it is better to reject the phone call or message that comes first, and if you ask for travel expenses, parking fees, or setting fees, you should refuse them firmly.This concludes the posting of the full installment vehicle mortgage that I have prepared today.Please take care of your health during the change of seasons and overcome difficult situations.Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image